It had me wondering why so I reached out to the

Canadian Pari-Mutuel Agency to request the numbers.

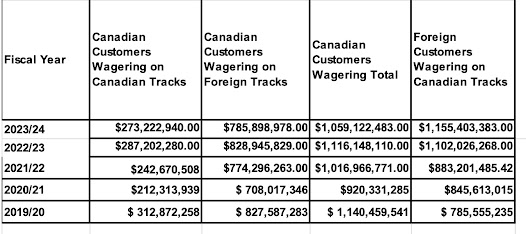

The charts below detail Ontario and Canadian historical wagering for the

past 19 years and for the last 6 months of 2024.

Woodbine represents

~70% of the 2023/2024 Canadian handle. The numbers are not very pretty.

Chart 1 Above (click to enlarge charts) - Canadian customers wagering more on U.S. tracks, less on Canadian tracks. International customers making up more and more handle (in 2024 making up more handle than domestic outlets)

The amount Canadian's wager on Canadian tracks has decreased significantly over the past 19 years, down about 60% when not accounting for inflation. Clearly Canadian Horseplayers are not pleased with the product.

I am not sure what happened the last half of 2024 as Canadian wagering plummeted 12% on Canadian tracks, 6.5% overall. An aberration or a sign of things to come?

The amount Canadians have wagered on foreign tracks has remained stable when not accounting for inflation. However foreign customer wagering on Canadian tracks has approximately doubled over the past 10 years.

The increase is likely due to expanding the signal distribution and the growth of CRW's. The strength of the US dollar has contributed, as well. Hypothetically, if CRW's represent 30% of Canadian wagering then they account for upwards of half all foreign wagering in Canadian dollars, yikes!

The question going forward is, has the signal expansion and CRW volume maxed out? And if so, how steep will future handle declines be?

One interesting question: Is a takeout hike in the offing?

The CPMA’s sole source of funding is the 0.8% levy placed on all wagers made in Canada. In 2006/07 the levy took in ~12 million. In 2024 it was $8 million. The CPMA can raise the levy to 1%, which is the highest they can go without receiving legislative approval. It will be interesting to see if they do increase the levy, and if the tracks absorb the 0.2% increase or if it will be passed on to the Horseplayers.

One must wonder what these numbers would look like if Woodbine was not bestowed a Canadian online wagering monopoly where they take advantage of Canadian Horseplayers with the unprecedented scheme of increasing the takeout rate on American racetracks.

A big thank you to PTP for sharing this information. And in the spirit of the blog, “have a great Monday everybody!”

Eric Poteck is a long time industry watcher, presenter at race conferences, horseplayer and general watchdog (aka pain in the butt) of the Canadian pari-mutuel business. He can be followed on twitter @Epo13.

.jpeg)

1 comment:

good stuff boys

Post a Comment